Biologics and Cross-Border Trade Drive the Next Phase of Growth in Cold Chain Pharmaceuticals Market

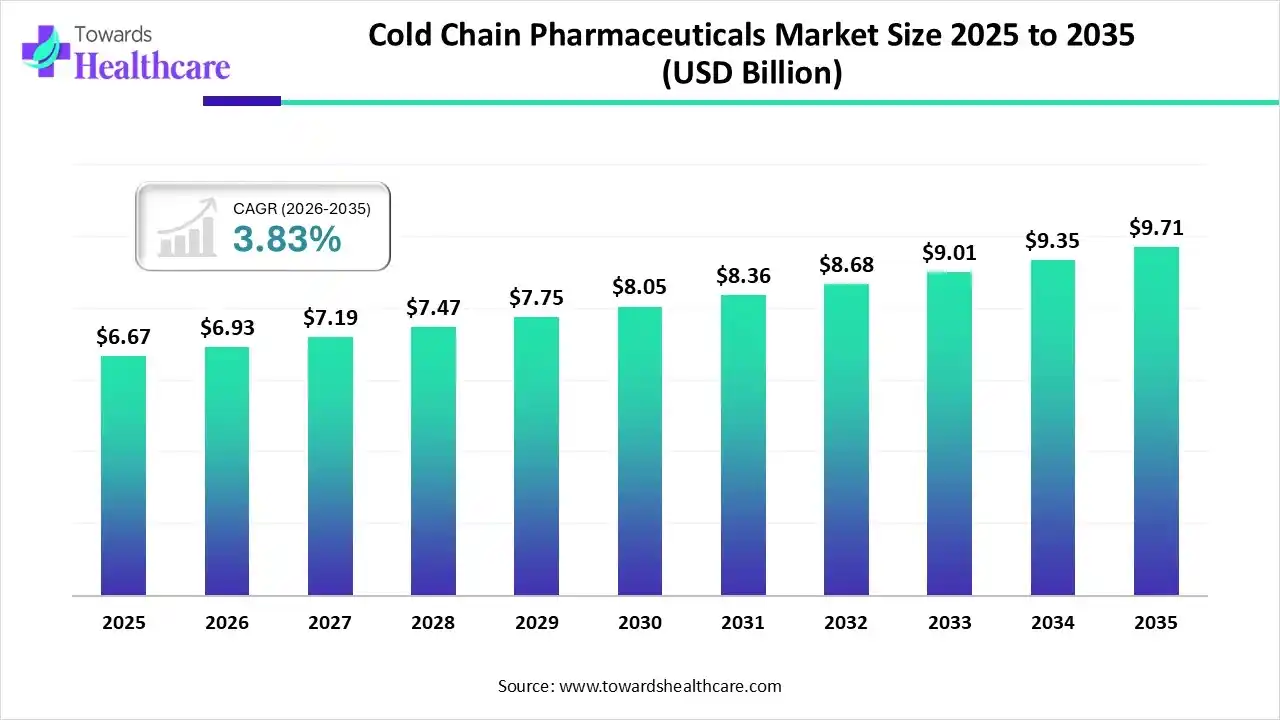

The global cold chain pharmaceuticals market size was valued at USD 6.67 billion in 2025 and is predicted to hit around USD 9.71 billion by 2035, rising at a 3.83% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Jan. 20, 2026 (GLOBE NEWSWIRE) -- The global cold chain pharmaceuticals market size is calculated at USD 6.93 billion in 2026 and is expected to reach around USD 9.71 billion by 2035, growing at a CAGR of 3.83% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5595

Key Takeaways

- The cold chain pharmaceuticals market is expected to cross USD 6.67 billion by 2025.

- Market projected at USD 9.71 billion by 2035.

- CAGR of 3.83% expected between 2026 and 2035

- North America held a major revenue share of the market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the coming years.

- By primary packaging type, the vials segment was dominant in the market in 2024.

- By primary packaging type, the pre-filled syringes segment is expected to grow rapidly during 2025-2034.

- By secondary packaging type, the cold boxes segment led the cold chain pharmaceuticals market in 2024.

- By secondary packaging type, the vaccine carriers segment is expected to show lucrative growth in the studied years.

- By usability type, the reusable segment registered dominance in the market in 2024 and is expected to witness the fastest growth in the coming years.

- By usability type, the single-use segment is predicted to grow at a notable CAGR during 2025-2034.

What is the Cold Chain Pharmaceuticals?

Primarily, the global cold chain pharmaceuticals market covers a vital, unbroken process of temperature-controlled storage and distribution for medicines sensitive to heat, which ensures their safety, quality, and efficiency from production to the patient. The global expansion is propelled by a rise in temperature-sensitive biologics, cell/gene therapies, and vaccines, which require precise temperature control, such as refrigerated, frozen, and cryogenic conditions. However, advanced blockchain technology offers a secure, immutable, and transparent record of a product's journey from producer to patient. This ensures data integrity, coupled with regulatory compliance, and supports eliminating counterfeiting.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Drivers in the Cold Chain Pharmaceuticals Market?

To fulfil the rising demand for biologics, regions are increasingly investing in healthcare infrastructure, particularly in developing economies, which enhances demand for extensive cold chain logistics to deliver therapeutics. Alongside, an accelerating utilization of IoT, RFID, sensors, and sophisticated analytics is enabling real-time tracking, monitoring, and data management, which fuels the global progression of cold chain solutions.

What are the Key Trends in the Cold Chain Pharmaceuticals Market?

- In January 2026, BD (Becton, Dickinson and Company) invested a $110 million to boost its production of prefillable syringes, supporting the rise of biologic and GLP-1 drug delivery in the U.S.

- In June 2025, Tjoapack widened its contract packaging and cold chain storage services in the United States and the Netherlands.

-

In June 2025, PLUSS Advanced Technologies partnered with Ecodome Logistics to launch reusable, IoT-enabled cold-chain boxes for nationwide pharmaceutical distribution.

What is the Vital Challenge in the Cold Chain Pharmaceuticals Market?

A major limitation in the emerging countries is a shortage of rigorous cold storage and refrigerated transport. Also, they are facing challenges in the initial higher investment and greater energy consumption for refrigeration and specialized equipment.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

Why did North America Dominate the Market in 2024?

North America captured a major revenue share of the market in 2024, due to the accelerating demand for biologic drugs, cell & gene therapies, and tailored medicine. Incorporation of stringent FDA and other regulatory standards mandates extensive temperature control, which fosters companies to invest in robust logistics and traceability. Besides this, the U.S. is promoting various technological integrations in cold chain logistics.

In the U.S. cold chain pharmaceuticals market, demand is rising as vaccines, biologics, and other temperature-sensitive therapies proliferate, driving expansions in refrigerated storage, packaging and logistics infrastructure across major distribution hubs. Investments by distributors to boost cold storage and automation reflect growing requirements to maintain drug integrity and meet stringent regulatory standards. Robust healthcare logistics growth and advanced monitoring technologies support this expanding segment of the broader pharmaceutical supply chain.

For instance,

- In January 2026, Dawsongroup TCS launched its Superbox cold chain system in the U.S. market.

How did the Asia Pacific Expand Significantly in the Market in 2024?

The cold chain pharmaceuticals market in the Asia Pacific is predicted to expand rapidly. APAC is experiencing a growth in clinical trials, outsourcing to hubs, especially China/India, with raised technological adoption, like IoT, blockchain and strict regulations. Besides this, the region is bolstering innovations in eco-friendly solutions, such as reusable temperature-controlled pallet shippers, recyclable insulated containers, and solar-powered cold storage units, mainly in Southeast Asia. Recently, UPS Healthcare expanded its capacity with an 11,500 m² facility featuring walk-in freezers capable of -20°C storage in Singapore.

In China, the cold chain pharmaceuticals market is rapidly expanding alongside broader cold chain logistics growth, with pharmaceutical cold storage areas and fleets increasing to support vaccine, blood product, and biologic distribution needs. Policy support, rising healthcare consumption, digital temperature monitoring deployment, and larger cold warehouses are key drivers improving service coverage and efficiency. As domestic pharmaceutical output grows, demand for reliable temperature-controlled logistics continues to strengthen across both urban and underserved regions.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By primary packaging type analysis

Why did the Vials Segment Lead the Market in 2024?

The vials segment captured the dominating share of the cold chain pharmaceuticals market in 2024. Spurring novelty in biologics and biosimilars is highly demanding for this packaging type. Continuous innovations in Ready-to-Use (RTU) systems, blow-fill-seal (BFS) technology, and automation in filling lines are boosting effectiveness and lowering risk. The market is promoting advances in sensors, QR codes for tracking these vials, as well as the adoption of recyclable or biodegradable alternatives.

Moreover, the pre-filled syringes segment is anticipated to witness rapid expansion. Globally progressing biologic drugs and immunization campaigns are majorly accelerating PFS usage, specifically for temperature-sensitive products. The globe is focusing on the development of polymer syringes, including SCHOTT TOPPAC, which facilitates benefits, such as minimal silicone, less tungsten, and increased stability. Firms are leveraging auto-injector cases or united devices to conceal needles, which makes them unique for home self-administration and for needle-phobic patients.

By secondary packaging type analysis

How did the Cold Boxes Segment Dominate the Market in 2024?

In 2024, the cold boxes segment held the biggest share of the cold chain pharmaceuticals market. By using EPS (Expanded Polystyrene) or PUR (Polyurethane), these boxes facilitate essential thermal insulation to encourage affordability and consistent temperature control. However, sophisticated Vacuum Insulated Panels (VIPs) and advanced Phase Change Materials (PCMs) are providing superior, long-duration thermal stability for ultra-cold/frozen products. Additionally, ongoing developments include fully recyclable fiber-based solutions, bio-based phase change materials (PCMs), paper-based thermal liners, and high-performance foams.

On the other hand, the vaccine carriers segment is estimated to show notable expansion. Accelerating government encouragement, technological breakthroughs, like real-time monitoring, automation, and escalating healthcare infrastructure, mainly in the Asia-Pacific is fueling the growth of vaccine carriers. Recent development comprises solar-powered cold storage units and battery-enabled portable active carriers, such as "Phloton", a portable, battery-powered active cooler, which is supporting last-mile vaccine delivery in remote areas.

By usability type analysis

Which Usability Type Led the Cold Chain Pharmaceuticals Market in 2024?

The reusable segment dominated the market in 2024 and will expand rapidly in the coming years. The worldwide rising pressure to lower carbon footprints and landfill waste further demands reusable systems, with regulations promoting closed-loop packaging solutions and extended producer responsibility (EPR). Alongside, companies are actively leveraging durable, high-performance, and affordable reusable packaging systems, including active cooling devices, pallet shippers, and data loggers.

However, the single-use segment is anticipated to expand significantly. It is primarily propelled by its rapid, versatile, minimal production expenditure, skipping of cleaning, and allowing easy scale-up for complex biologics, especially cell/gene therapies, mAbs, and vaccines. Stopping the time consumption of clean-in-place (CIP) and sterilize-in-place (SIP) procedures enables expedited changeovers and quicker production cycles, which is prominently advantageous for multi-product facilities and just-in-time manufacturing.

Browse More Insights of Towards Healthcare:

The global cold storage market size is predicted to expand from USD 172.9 billion in 2025 to USD 537.25 billion by 2035, growing at a CAGR of 12% during the forecast period from 2026 to 2035.

The global cold plasma market size touched US$ 2.92 billion in 2024, with expectations of climbing to US$ 3.34 billion in 2025 and hitting US$ 11.14 billion by 2034, driven by a CAGR of 14.35% over the forecast period.

The global cold pain therapy market size is calculated at USD 2.49 billion in 2024, grew to USD 2.59 billion in 2025, and is projected to reach around USD 3.70 billion by 2034. The market is expanding at a CAGR of 4.04% between 2025 and 2034.

The global cell and gene therapy cold chain logistics market size is calculated at US$ 1.89 billion in 2024, grew to US$ 2.19 billion in 2025, and is projected to reach around US$ 8.06 billion by 2034. The market is expanding at a CAGR of 15.64% between 2025 and 2034.

The global life science logistics market size is calculated at US$ 127.7 in 2024, grew to US$ 137.23 billion in 2025, and is projected to reach around US$ 262.51 billion by 2034. The market is expanding at a CAGR of 7.46% between 2025 and 2034.

The drug supply chain market is rapidly advancing on a global scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034.

The global over the counter (OTC) drugs market size is calculated at USD 142.27 billion in 2025, grew to USD 151.59 billion in 2026, and is projected to reach around USD 268.32 billion by 2035.The market is expanding at a CAGR of 6.55% between 2026 and 2035.

The global cell and gene supply chain solutions market size is calculated at US$ 3.54 billion in 2024, grew to US$ 4.09 billion in 2025, and is projected to reach around US$ 14.95 billion by 2034. The market is expanding at a CAGR of 15.54% between 2025 and 2034.

The global cell and gene therapy third-party logistics market size is calculated at US$ 1.81 billion in 2025, grew to US$ 2.27 billion in 2026, and is projected to reach around US$ 16.95 billion by 2035. The market is expanding at a CAGR of 25.05% between 2026 and 2035.

The global blockchain in clinical trials market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

What are the Recent Developments in the Cold Chain Pharmaceuticals Market?

- In November 2025, ACG launched DryPod, a next-generation desiccant-based cold-form laminate developed to protect highly moisture-sensitive drug molecules.

- In October 2025, Peli BioThermal broadened its cold chain portfolio with the Evo acquisition to bolster CGT logistics.

- In August 2025, Accord BioPharma commercially introduced IMULDOSA (ustekinumab-srlf) prefilled syringes at the affordable WAC price among branded biosimilars to STELARA (ustekinumab).

Cold Chain Pharmaceuticals Market Key Players List

- CSafe

- Cold Chain Technologies

- EMBALL’ISO

- Cryopak

- Peli Bio Thermal

- Temperpack

- SOFRIGAM

- Intelsius

- SEE

- Nordic Cold Chain Solutions

- Sonoco Thermosafe

Segments Covered in the Report

By Type of Primary Packaging

- Vials

- Ampoules

- Pre-filled Syringes

- Bags

By Type of Secondary Packaging

- Cold Boxes

- Vaccine Carriers

- Insulated Containers

By Type of Usability

- Reusable

- Single-use

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5595

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.